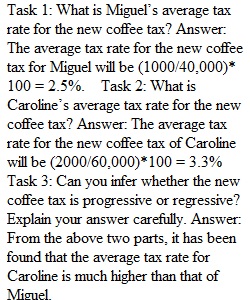

Q PUBLIC FINANCE IN-CLASS WORKSHEET 1 This question examines the federal budget. You will use a balance sheet to identify whether the federal government is running a budget surplus or deficit. Below, you are provided with an incomplete federal budget. It is incomplete because you are not given a value for federal expenditures on national defense. FEDERAL BUDGET Revenues Expenditures Individual Income Taxes: $23M Health: $35M Social Insurance & Pensions & Retirement Receipts: $15M Income Security: $12M Corporate Income Taxes: $12M National Defense: _____ Excise Taxes: $3M Interest on Debt: $2M Task 1: What is the total amount of federal government revenues in the federal budget presented above? Task 2: Suppose that national defense spending is equal to $2M. Is the federal budget in surplus or in deficit? By how much? Task 3: Suppose that national defense spending is equal to $7M. Is the federal budget in surplus or in deficit? By how much? Task 4: Fill in the blanks in the following statement: As long as federal expenditures on national defense are less than ________, the Federal Budget will be in ________________. PUBLIC FINANCE IN-CLASS WORKSHEET 3 This question examines the progressive and regressive natures of different taxes. You will use taxes paid and incomes for different individuals to identify whether a particular tax is progressive or regressive in nature. Suppose that the government decides to impose an excise tax on two commodities: coffee and soda. These two new taxes are intended to reduce caffeine consumption. Below, you are provided information about the incomes and tax payments for two different consumers of coffee and soda. Miguel earns an income of $40,000. He must pay $1,000 for the new coffee tax and $500 for the new soda tax. Caroline earns an income of $60,000. She must pay $2,000 for the new coffee tax and $700 for the new soda tax. Task 1: What is Miguel’s average tax rate for the new coffee tax? Task 2: What is Caroline’s average tax rate for the new coffee tax? Task 3: Can you infer whether the new coffee tax is progressive or regressive? Explain your answer carefully. Task 4: What is Miguel’s average tax rate for the new soda tax? Task 5: What is Caroline’s average tax rate for the new soda tax? Task 6: Can you infer whether the new soda tax is progressive or regressive? Explain you answer carefully.

View Related Questions